Banks Are Known to Act as Financial Intermediaries.

A group of banks join together and undertake Consortium financing or Syndicate financing by which companies are enabled to buy huge assets such as the purchase of a ship. Financial intermediaries means it intermediate in providing various financial services.

Financial Institutions Banking Structure Of Bangladesh সন তন দ র আড ড Financial Institutions Financial Bank Financial

An intermediary is one who stands between two other parties.

. Bank deposits credit-debt money. They are the most popular financial intermediaries in the world. Between savers and other savers b.

Terms in this set 70 Financial Intermediary. An intermediary is one who stands between two other parties. Audit and Loan Review.

Between whom do banks serve this function. Types of Financial Intermediaries. Banks are known as financial intermediaries because the banks form a bridge between.

Undoubtedly banks are the most popular financial intermediaries in the world. Pooling the resources of small savers Many borrowers require large sums while many savers offer small sums. Between whom do banks serve this function.

Banks are a financial intermediarythat is an institution that operates between a saver who deposits money in a bank and a borrower who receives a loan from that bank. Between borrowers and other borrowers d. Banks are known to act as financial intermediaries.

There are several financial intermediaries formed to serve the different aims and objectives of the customers or members or lenders and borrowers. A Financial institution that facilitates the exchange of funds between savers and spenders by taking in funds from savers and then lending those funds to borrowers and. The institutions that are commonly referred to as financial intermediaries include commercial banks Top Banks in the USA According to the US Federal Deposit Insurance Corporation there were 6799 FDIC-insured commercial banks in the.

Banks are a financial intermediarythat is an institution that operates between a saver who deposits money in a bank and a borrower who receives a loan from that bank. A financial intermediary is an entity that acts as the middleman between two parties in a financial transaction such as a commercial bank investment bank mutual fund or. The most ancient way in which these institutions act as middlemen is by connecting lenders and borrowers.

Banks different kinds of specialties include savings investing lending and many other sub-categories. Banks as Financial Intermediaries. Between savers and borrowers c.

The oldest way in which these institutions act as intermediaries is by connecting lenders and borrowers. Common types include commercial banks investment banks stockbrokers pooled investment funds and stock exchanges. Learn the definition of financial intermediation see.

There are 3 different kinds of money - currency legal tender money. Banks are known to act as financial intermediaries. Financial intermediaries are the financial institutions that act as the middlemen between the financial lenders and the financial borrowers such institutions are for example.

A Financial system is a system that allows the exchange of funds between financial market A modern financial system may include banks public sector or private sector financial markets financial It is also termed as financial intermediaries because they act as middlemen between the savers and borrowers. Why banks are called financial intermediaries. The bank is a well-known financial intermediary or an organization that helps connect money lenders and spenders under one institution.

Thus banks act as financial intermediariesthey bring savers and borrowers together. Financial intermediaries include other institutions in the financial market such as insurance companies and pension funds but they will not be included in this discussion because they are not considered. Commercial banks are financial intermediaries between the central bank and the money using economy.

The brokerage companies insurance companies banks finance companies and credit unions among others Bhole Mahakud 2009 p. Banks are financial intermediaries because they grant loans and have much to do with finances. Organizes records and reports all transactions that represent the financial condition of the bank including how efficiently and profitably the bank is operated.

While borrowers are in need of that excess money for some period of. Money is created by the monetary system. A financial intermediary is an institution or individual that serves as a middleman among diverse parties in order to facilitate financial transactions.

Financial system Wikipedia 2020. Depositors need to deposit their surplus money so that they can gain some interest Borrowers need to raise money in the form of loan. Thus banks act as financial intermediariesthey bring savers and borrowers together.

These entities are explained in detail below. Some of the roles played by banks as financial intermediaries are as follows. All the funds deposited.

Banks act as financial intermediaries because they stand between savers and borrowers. Banks are a financial intermediarythat is an institution that operates between a saver who deposits money in a bank and a borrower who receives a loan from that bank. Between the federal government and savers.

The central and commercial banks are the most well known financial intermediaries simplifying the lending and borrowing process along with providing various. Economics questions and answers. Banks are the most popular financial intermediaries in the world as they are highly regulated by the government and play an important role in economic stability.

Make sure the bank is safe from risks such as internal and external fraud. All the funds deposited are mingled in one. Financial intermediaries reallocate otherwise uninvested capital to productive enterprises through a.

As a financial intermediary banks not only promote investments but also enable corporate sector to go in for huge borrowings to undertake large scale business both within and outside the country. A financial intermediary refers to an institution that acts as a middleman between two parties in order to facilitate a financial transaction. Lenders have excess money that they need to lend to earn some interest.

Banks accept deposits from the public and creates credit products for borrowers. Banks are known to act as financial intermediaries. They come in multiple specialties that include saving investing lending and many other sub-categories to fit specific criteria.

Borrowers receive loans from banks and repay the loans with interest. The central-commercial banking system. What are examples of non-bank financial institutions.

Central bank reserves base money - that are created by 3 different monetary system. Savers place deposits with banks and then receive interest payments and withdraw money.

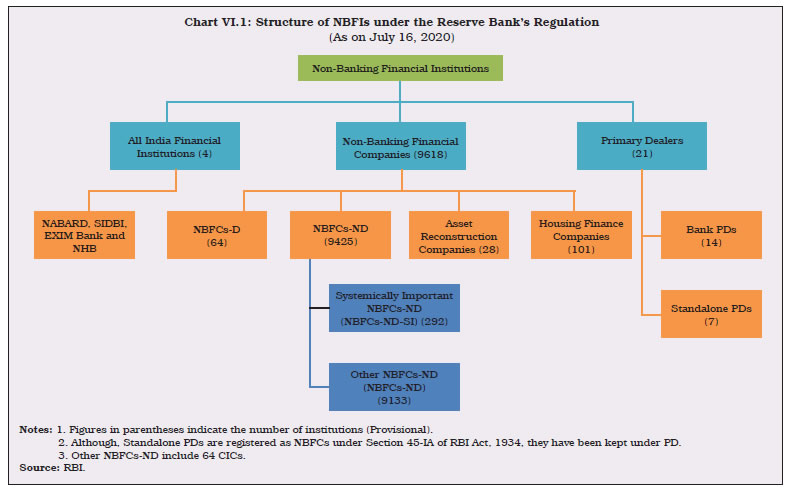

Reserve Bank Of India Publications

What Is Defi Blockchain Technology Finance Segmentation

How Insurers Differ From Banks Implications For Systemic Regulation Vox Cepr Policy Portal

Reading Banks As Financial Intermediaries Ivy Tech Introduction To Business

Banks As Financial Intermediaries Introduction To Business

An Economic Account For Non Bank Financial Intermediation As An Extension Of The National Balance Sheet Accounts

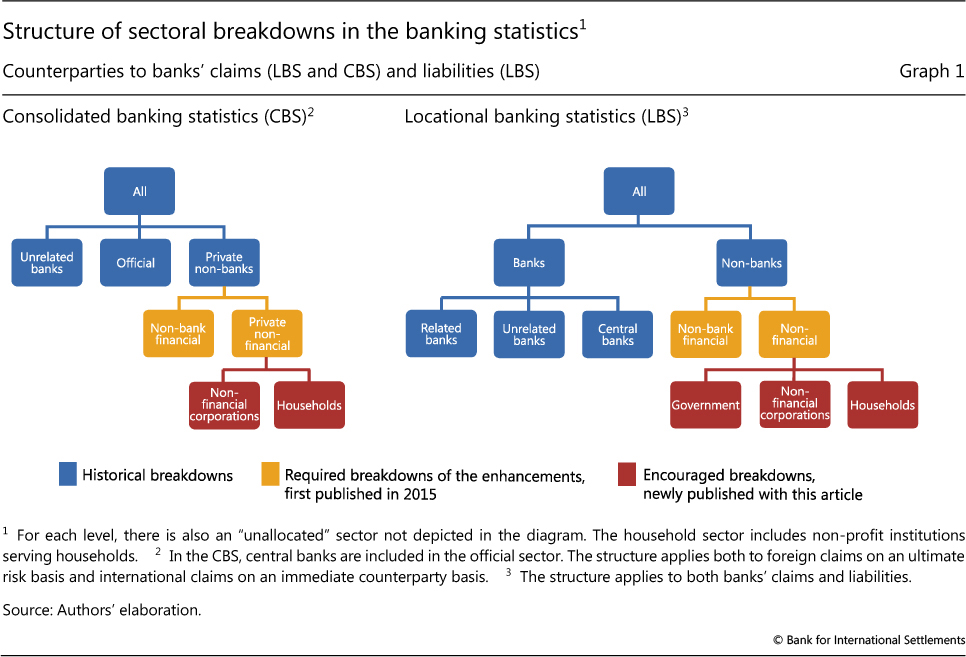

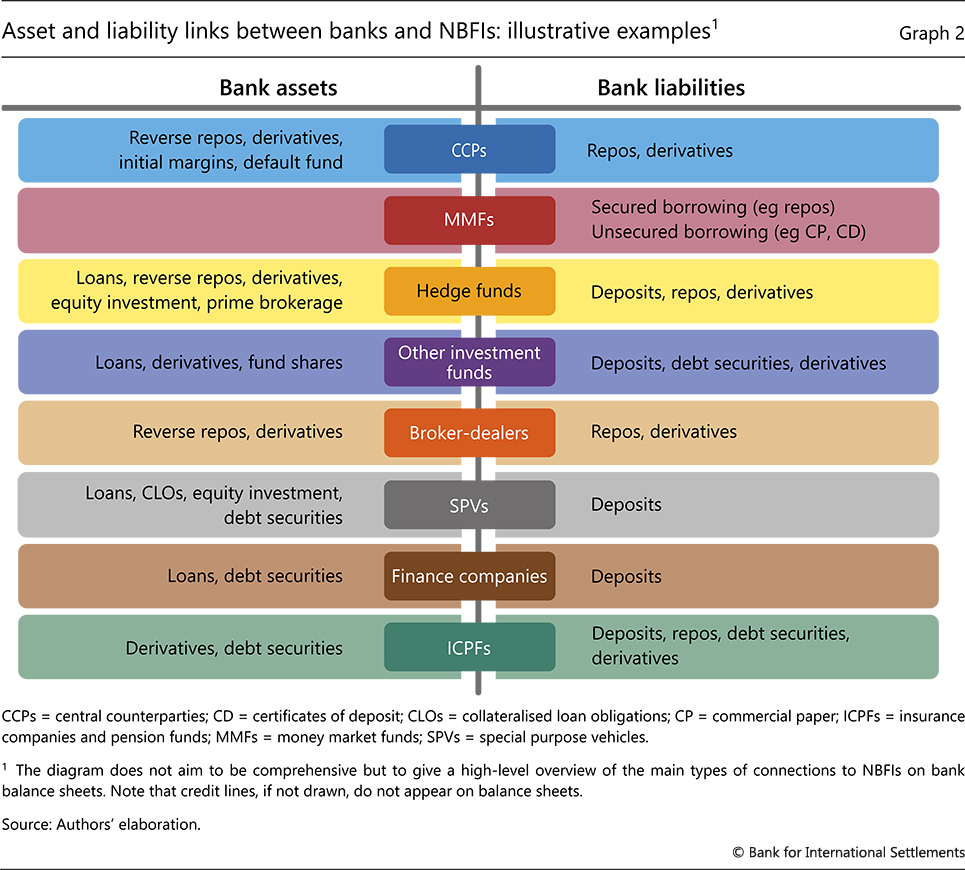

Non Bank Counterparties In International Banking

Doc Chapter I Roshan Sapkota Academia Edu

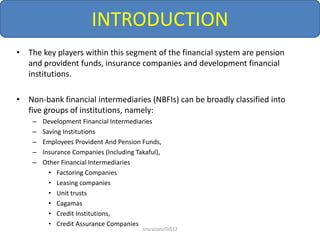

5 Non Bank Financial Intermediaries

How Insurers Differ From Banks Implications For Systemic Regulation Vox Cepr Policy Portal

Reserve Bank Of India Publications

Of Financial Institutions Ii Ppt Download

What Is Defi A Guide To New Decentralized Finance System Finance Banking Industry System

L1 P9 Classification Of Banks And Non Banking Financial Institutions Nbfi Youtube

U S Financial Regulatory Structure 2016 Financial Regulation Financial Regulatory

Financial Institutions Intelligent Economist

Cross Border Links Between Banks And Non Bank Financial Institutions

Role Of Financial Institutions Top 10 Roles In Economic Development

Comments

Post a Comment